Today, we’re going to cover a little bit about our banking process! We’re going to talk about how we get paid, how we pay employees, and a little bit about Profit First, which is a system that we use to handle finances. Profit First makes sure we have a little bit of profits at the end of every quarter and every year.

Novo

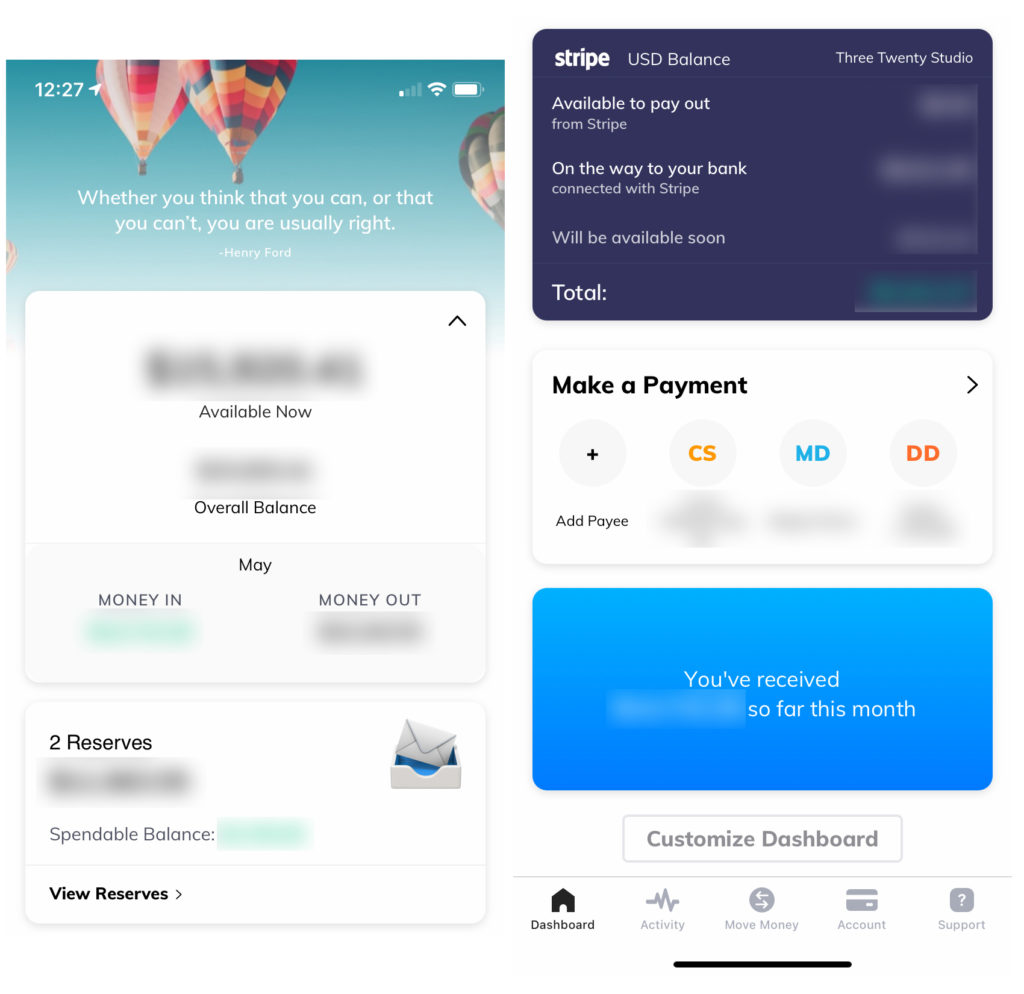

For our everyday business banking, we use an online bank called NOVO and we think they are pretty awesome! We used to use Aslo, but they got shut down by the big bank that bought them (and we’re pretty sad about it). But we found NOVO and we really love it. We are easily able to integrate that with Square, Stripe to see statistics inside of our dashboard. And with Dubsado, we have all of our invoices paid through Stripe. From there it automatically gets sent over to our NOVO account. This is really great for us because it keeps everything online. There are no physical banks that we need to go to and with Novo, there’s no fees. It’s the perfect way to get things set up. And it’s pretty quick.

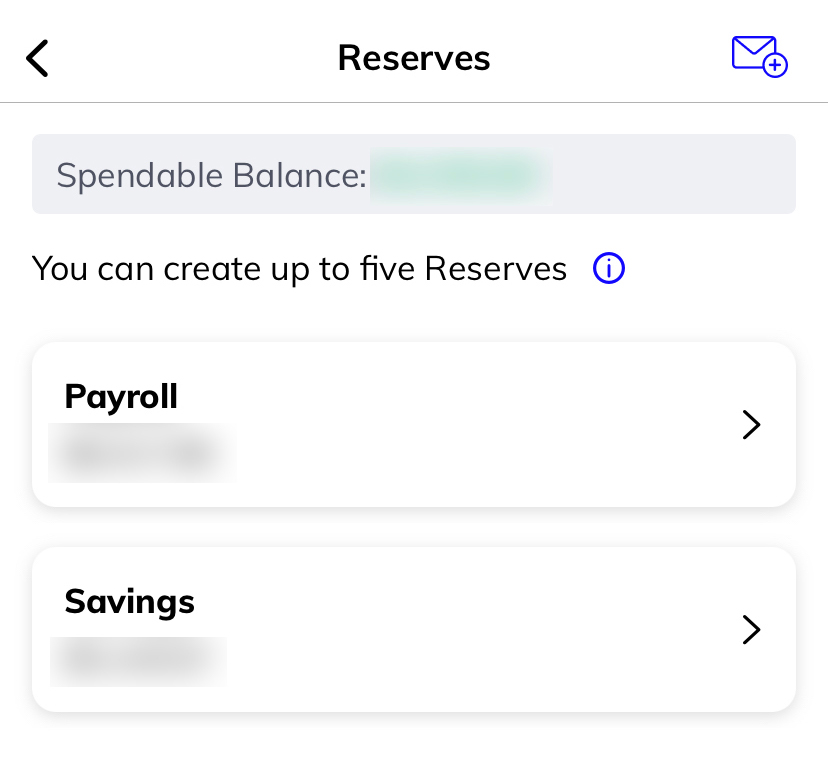

Another thing we love about NOVO is the option to direct deposit. Whenever it comes time to pay our employees, or pay ourselves, we just direct deposit right into the appropriate account. Another really cool thing that we like about NOVO is that they have something they call “reserves.” These are basically little digital envelopes that you can put money in to use for something else. So, for example, we have an envelope for savings and we have an envelope for payroll. That way when it comes time for payroll we know there is already money in that envelope to pay our employees with.

Hancock Whitney

While we love online only and using NOVO as our primary bank, we do have a secondary account at Hancock Whitney that has brick and mortar stores. That way we can go in and deposit a check when we need to. We do work for some clients that pay with checks that aren’t easy to digitally deposit. Sometimes we have to deposit those into a real brick and mortar bank, which is why we have that account. That account also plays into our Profit First system.

Profit First

So if you’re not using Profit First to run your business, you should definitely check it out. This is the idea that you take your profits first and then run your business off of the rest. Whether you are starting off with one or ten percent, it is going to ensure that your business is profitable from the get-go. This is a great way to make sure that you are not overspending on frivolous things. What we do is have profits taken out and taxes taken out before we even run our business.

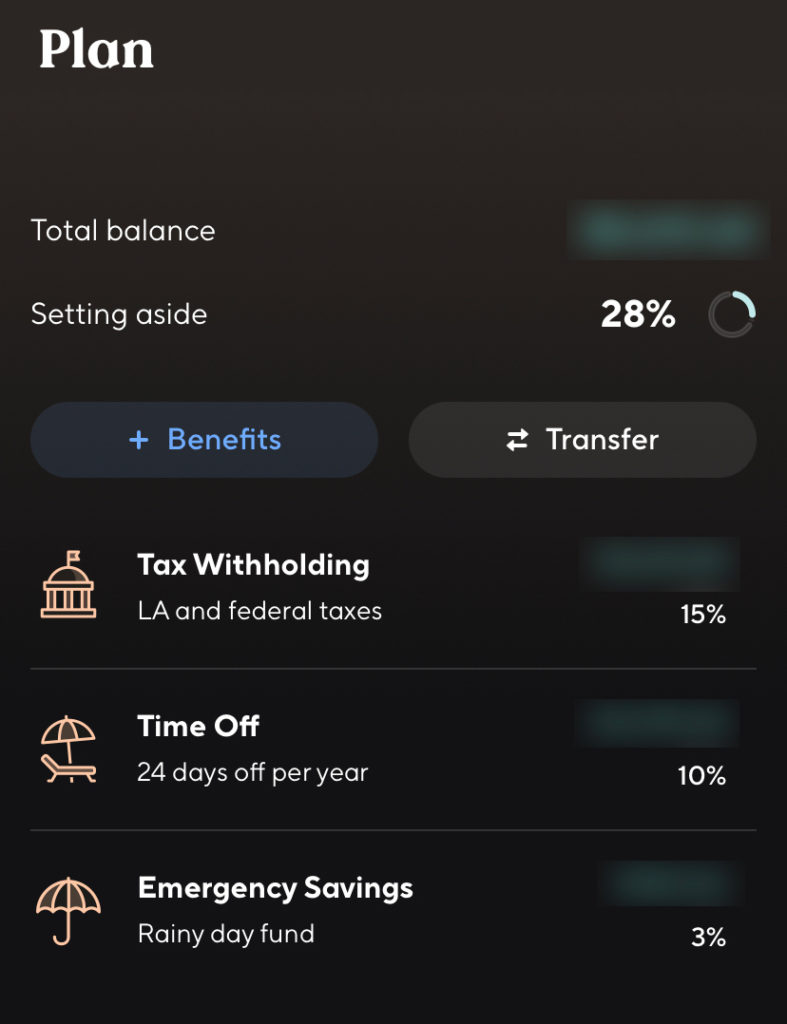

Catch

A percentage is taken out for every check that we get, regardless of where it comes from. We do this using a system called Catch. This is another online system that we love. They monitor our bank and take out a certain percentage for taxes, thirty percent for profits, and a certain percentage for savings. This is how we have it set up, but you can adjust it however you want. As a small business, you are responsible for paying taxes quarterly or yearly. We try to make sure we have the money set aside when the time comes to make those tax payments. We don’t want to scrounge around looking for thousands of dollars to pay the IRS.

Using the Profit First system, mixed with Catch, is just a really great way to get your finances in order. We love everything that Catch does. We encourage you to look into Catch and even read the book Profit First. It is not a long read and they even have an audio book. It is going to set you up to be a profitable business from the jump and it’s super easy to do this when you’re first starting out. If you’re a business that has been running for a long time, you’re going to want to take this profit first system pretty slowly. They talk about how to do that in the book so be sure to check that out.

We hope that this is beneficial for you and hope that it can help you better run your business. Make sure that you set aside profits for yourself and make sure you set aside taxes and all that stuff that way you stay on the up and up with the IRS. Be sure to reach out to us if you have any questions! And if you do happen to start using any of these systems, reach out and let us know what you think!